About SDR

SDR Investor Guide and Programme Disclosure

Download the SDR Investor guide and Programme Disclosure here:

SDR Key Features

Invest in overseas listed companies via SDRs through a single marketplace

Local brokerage and fees applies. No additional overseas trading fees, foreign exchange fees, or management fees

Traded, cleared and settled during SGX-ST market hours in SGD

SDRs are custodised with CDP

Ability to convert between SDRs and underlying securities

Announcements on corporate action events relating to SDRs will be published on this website

What is an SDR?

An SDR is an instrument that gives its holder beneficial interest in an Underlying Security listed on a foreign market.

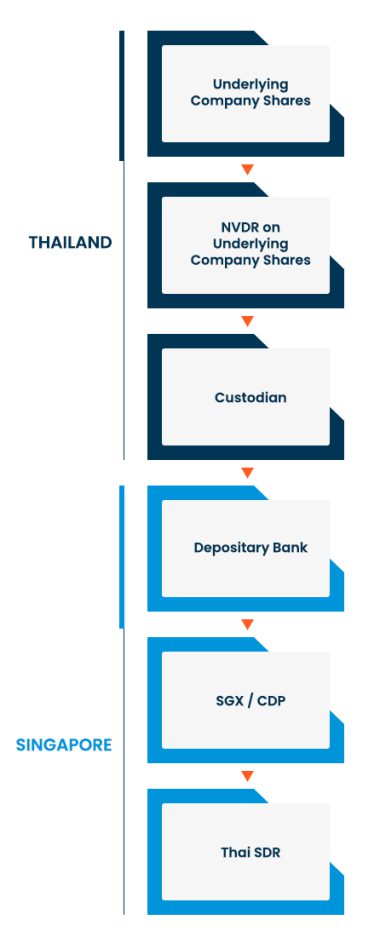

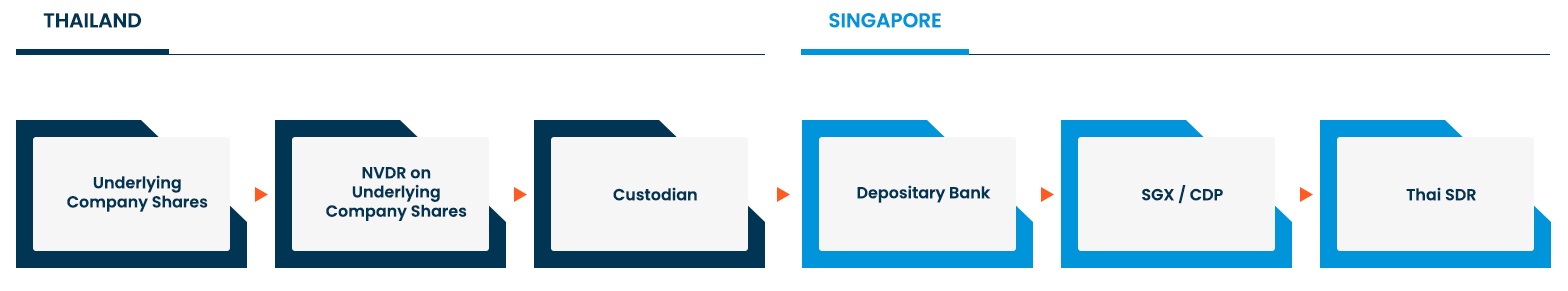

In the case of a Thai SDR, the Underlying Security are the Underlying Securities. A holder of the Underlying Securities has a beneficial interest in Underlying Shares of a company listed on the SET. Hence, by holding an SDR, you have beneficial interest in the Underlying Shares of a company listed on the SET.

In the case of a Hong Kong SDR, the Underlying Security are the Underlying Shares listed on the SEHK. By holding an SDR, you have beneficial interest in the Underlying Shares of a company listed on the SEHK.

The SDR programme is an unsponsored programme issued by the Depository. There is no contractual relationship between the Underlying Company and the Depository.

SDRs are issued and traded on SGX-ST GlobalQuote in Singapore dollars. Distributions in relation to the SDRs are made in Singapore dollars unless otherwise specified.

What is the structure of an SDR?

By holding an SDR, you have exposure to the financial performance of the Underlying Security and certain benefits attached to the Underlying Security, without directly acquiring the Underlying Security.

Each SDR is represented by a specific number of Underlying Security which is deposited with a Custodian appointed by the Depository. The Underlying Security is registered in the name of the Custodian and held on behalf of the Depository who in turn holds the beneficial interest in the Underlying Security on trust for you.

Differences between holding the SDRs vs Underlying Securities

| SDRs | Underlying Securities | |

| Ownership | SDRs give you beneficial interest in the Underlying Securities. The Underlying Securities are registered in the name of the Custodian and held on behalf of the Depository who in turn holds beneficial interest in the Underlying Securities on trust for you. | You own the Underlying Securities directly. |

| Trading parameters | SDRs are traded in Singapore dollars on SGX-ST GlobalQuote during SGX market hours. | Underlying Securities are traded in the relevant local currency during the relevant market hours of the Underlying Market. |

| Custody arrangement | SDRs are custodised with the CDP. | Underlying Securities are not custodised with the CDP. They are held with your respective custodian. |

| Corporate action entitlements |

The Depository will use reasonable endeavours to pass on the benefits of a corporate action to you. However, as set out in the terms and conditions of the SDRs, your ability to participate in certain corporate actions may be restricted by regulations, conditions imposed by the Underlying Company. The timelines for participating in a corporate action, if made available to Holders, may differ from the timelines announced by the Underlying Company. |

You will be able to directly participate in the corporate actions, subject to applicable regulations and conditions imposed by the Underlying Company. |

Investor Suitability

Singapore Depository Receipts (SDR) which are classified as Excluded Investment Products (EIP) are generally for investors who expect low to moderate likelihood of loss of principal investment amount, with generally smaller potential returns. Investors who invest in this product should have a basic understanding of financial instruments with standardised terms and no unusual or complicated features.

SDR Key Features

- SDRs are quoted and traded on SGX-ST GlobalQuote during SGX market hours.

- SDRs are classified as Excluded Investment Products (EIP).

- You can buy and sell SDRs through your broker, in the same way you buy and sell shares traded on SGX.

- SDRs will be traded in Singapore dollars and you will receive any cash distributions in relation to your SDRs in Singapore dollars.

- When you own SDRs, you have the right to obtain ownership and title to the Underlying NVDR. To do so, you will need to submit a Cancellation request to the Depository.